What is a Lien Sheet

|

|

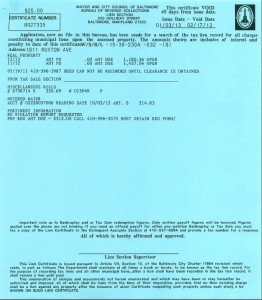

When buying or selling a property a title company will do a Title Search. These companies do much more than just check the land records to confirm who the owner is. They must check for Mortgages, judgments against the seller, bankruptcies, and make sure all taxes are paid up. One tool they use is a Lien Sheet (This is in Baltimore City other municipalities may handle it differently). Lien sheets have a list of all city bills due. This includes water bills, property taxes, fines, and special assessments. The Lien Sheet will have a date that the payoff amount is good through. This is 45 days so there is plenty of time to get a property settled. For an extra charge you can also get a violation report. This is especially important for vacant and run down buildings.

How Much Does a Lien Sheet Cost

A lien sheet will cost $25. If you add the violation report it is $55. It seems a bit unfair that you have to pay the city to find out how much you owe them, but that’s the rules. Normally your title company will order it when handling a closing of a property. However if you want to check out a property yourself you can order them online here: Baltimore Lien Sheets

What a Lien Sheet Does Not Cover

Don’t be misled. Despite the what the name might imply, a lien sheet does not list all liens against the property. It is only for city liens. It does not include mortgages, mechanics liens, and other liens against the property.

Tax Sale

Many properties that investors buy have some kind of distress in either the property or the owners financial position. This is why we can get such bargain prices. Often these properties are in tax sale. This means a tax lien has been sold to an investor and there may be extra interest and legal fees due. If the property is in tax sale the lien sheet will say you must get clearance from the tax sale office. You can find more information about Baltimore liens here: Baltimore City Lien Sheet FAQ

Of course all of this is normally handled by your title company. However if you are marketing directly to sellers, knowing your way around the tax and lien office will come in handy.

Happy investing – Ned

Get FREE investing tips and bargain wholesale properties via e-mail.

Get FREE investing tips and bargain wholesale properties via e-mail.

7 responses so far ↓

1 Lucy // Jun 3, 2013 at 1:37 am

Awesome! There’s so much more I’m learning about tax lien investing. Where would I get a sheet like this in AL without a title atty and how soon will I need one for a lien that expires in 2015?

2 Steve (1 comments.) // Jun 5, 2013 at 12:38 pm

I see that you have quite a few articles discussing tax sales in Maryland. I live on the Eastern Shore and would like to get into the tax sale opportunities myself. In particular, I’ve noticed this one building lot in a development that the person owes roughly 1K in back taxes. I looked the property up and he has a mortgage against it. It looks like he was the developer and as he has sold the lot/home packages he would pay off enough of the note to satisfy the one lot and the bank would clear the deed for that one lot and leave the rest of the lots in the subdivision on the note. This particular lot still appears to be on the note. Would this make purchasing the tax lien cert on this empty lot more of a risk? What is your experience with this sort of thing? Any help woud be greatly appreciated.

3 Ned // Jun 7, 2013 at 12:42 pm

Lucy,

I have no idea for AL, they may have an entirely different process.

Regarding you ta lien, in MD and I expect most areas you would not need something like this unless and until you foreclose on your lien and you are ready to record your deed.

Thanks for reading – Ned

4 Ned // Jun 7, 2013 at 12:45 pm

It may mean the lender is more likely to redeem if the builder does not. As far as the risk of loss it has nothing to do with it. The risk of losing money is dependent on the value of the property. Can you foreclose and sell the property for more that enough to cover your costs and the costs to acquire the property. That would roughly be $200 in leagal fees and 2 years worth of taxes in addition to the lien. Good luck – Ned

5 Mike // Aug 9, 2013 at 4:49 pm

I have identified several vacant houses that are in tax sale. I plan on buying some of these if the owner will sell. One of them was from last year and the foreclosure started in Jan of this year. What do you think the attorneys fees would be on that one? Do you think this is a good strategy? Seems like the ultimate motivated seller!

6 Ned // Aug 9, 2013 at 10:35 pm

Mike, Yes this can be a very good strategy. The legal fees will likely be $2,000 – $2500 depending on how far along they are in the case.

7 Mike // Aug 12, 2013 at 9:24 am

Ned,

In reference to my question above, an owner whose property has a tax lien against is allowed to sell, correct?