The work will wait while you show the child a rainbow; but the rainbow won’t wait while you do the work.

~ Patricia Clafford

Another Great Quote

February 7th, 2013 · Comments Off on Another Great Quote

Comments Off on Another Great QuoteTags: Quotes

Congratulations to the Baltimore Ravens!

February 4th, 2013 · Comments Off on Congratulations to the Baltimore Ravens!

Comments Off on Congratulations to the Baltimore Ravens!Tags: Humor

Did you miss a deal?

January 30th, 2013 · Comments Off on Did you miss a deal?

Yesterday I sent out an e-mail with a great deal on a rental property.

Today five more properties went out to my list,

All under $17,000!!!

If you missed it, sign up for our buyers list by clicking the button near the top right of the page. Tax sale foreclosures are coming in regularly now and more properties will go out to the list soon.

Happy investing – Ned

PS: No you didn’t miss out on anything. The deals that just went out can be seen here CrabProperties.com

Comments Off on Did you miss a deal?Tags: Advanced tips · Beginner · real estate

Lien Sheet

January 24th, 2013 · 7 Comments

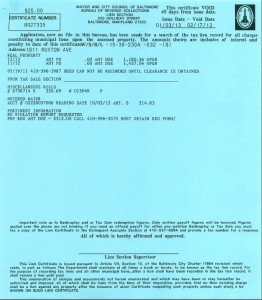

What is a Lien Sheet

|

|

When buying or selling a property a title company will do a Title Search. These companies do much more than just check the land records to confirm who the owner is. They must check for Mortgages, judgments against the seller, bankruptcies, and make sure all taxes are paid up. One tool they use is a Lien Sheet (This is in Baltimore City other municipalities may handle it differently). Lien sheets have a list of all city bills due. This includes water bills, property taxes, fines, and special assessments. The Lien Sheet will have a date that the payoff amount is good through. This is 45 days so there is plenty of time to get a property settled. For an extra charge you can also get a violation report. This is especially important for vacant and run down buildings.

How Much Does a Lien Sheet Cost

A lien sheet will cost $25. If you add the violation report it is $55. It seems a bit unfair that you have to pay the city to find out how much you owe them, but that’s the rules. Normally your title company will order it when handling a closing of a property. However if you want to check out a property yourself you can order them online here: Baltimore Lien Sheets

What a Lien Sheet Does Not Cover

Don’t be misled. Despite the what the name might imply, a lien sheet does not list all liens against the property. It is only for city liens. It does not include mortgages, mechanics liens, and other liens against the property.

Tax Sale

Many properties that investors buy have some kind of distress in either the property or the owners financial position. This is why we can get such bargain prices. Often these properties are in tax sale. This means a tax lien has been sold to an investor and there may be extra interest and legal fees due. If the property is in tax sale the lien sheet will say you must get clearance from the tax sale office. You can find more information about Baltimore liens here: Baltimore City Lien Sheet FAQ

Of course all of this is normally handled by your title company. However if you are marketing directly to sellers, knowing your way around the tax and lien office will come in handy.

Happy investing – Ned

→ 7 CommentsTags: Advanced tips · real estate · Tax Liens

Quote of the Day

January 23rd, 2013 · Comments Off on Quote of the Day

Good results without good planning, come from good luck not good management

David Jaquith

Comments Off on Quote of the DayTags: Quotes · Success & Wealth Building

Real Estate Location Location Location, Is It Really Imporant?

January 16th, 2013 · 1 Comment

What are the Best Neighborhoods to Invest in?

A common question I hear is “What are the best neighborhoods to invest in?” The answer is, any neighborhood. There are good deals in any area, and the quality of the deal is more important than where it is located.

Often “hot” neighborhoods have ready buyers but there is much more competition for the deals. It can be very tough to find deals in a hot market because so many other investors are working the area. Prices get driven up. Higher costs mean lower profits.

Conversely there can be competition for buyers. When the market was booming, some neighborhoods became hot with investors, but without much thought of demand for finished product. Washington Village (or Pigtown) in Baltimore was a great example. There were so many investors that when the rehabs were completed there weren’t enough buyers. It is often a trade off, do you want it easier to find a deal or easier to sell it.

The Three Most Important Word In Real Estate

Location Location Location

You’ve heard it before “The three most important words in real estate are Location Location Location.” My Dad used to tell me that. My dad was a smart man but on this, he was wrong! The three most important words in Real Estate Investing are Cash Flow and Equity. A bad deal, in a great area, is still a bad deal. However if you could buy a property for no money down that had $10,000 a year in positive cash flow, would you really care where it was?

Let’s say you pay top dollar for a property in a great neighborhood (property 1) . The high price paid means you have no equity and negative cash flow. Are you really better off than buying in a lesser neighborhood at 50 cents on the dollar (property 2)? Property 2 would have positive cash flow and built in equity. Even if the better location appreciates faster it could be many many years before that investment pays off. In fact by leveraging the equity in the second property and doing things like 1031 exchanges, the better neighborhood property may never catch up to the returns you get on property 2.

It’s sad that many investors I know never learned that important lesson even after years of investing. If you are a collector, pick pretty buildings in nice neighborhoods. If you are an investor, whether in a great neighborhood or not, focus on your return on investment. That would be Cash Flow and Equity.

Happy investing,

Ned

→ 1 CommentTags: Beginner · real estate

Banks Hate Short Sales

December 3rd, 2012 · 2 Comments

The following video shows the real reason that Banks hate short sales.

No wonder they take so long to get closed.

Happy Investing – Ned

PS: If you can’t get a short sale done, get Steph Davis’ E-Book on how to buy & Flip REOs

→ 2 CommentsTags: Humor · real estate

Quote of the Day

November 12th, 2012 · 1 Comment

“You don’t get paid for the hour. You get paid for the value you bring to the hour.”

→ 1 CommentTags: Quotes · Success & Wealth Building

Are Mortgage Accelerators A Scam

August 21st, 2012 · Comments Off on Are Mortgage Accelerators A Scam

Guest Post

I met Jeffrey Smith, on the bigger pockets website. One of his websites Ultimate Online Bargains has a number of in-depth articles. It’s worth checking out. Jeffrey has allowed me to share this one here.

Mortgage Accelerators

Recently, there seems to be a viral spread of so-called “Mortgage Accelerator” products, which promise miracles of drastic reductions in the interest expense and pay-off time of your home mortgage. These products are usually quite expensive and they perform no miracles. The producers of these products are preying on the financial illiteracy of the general population.

The products are of a form similar to a spreadsheet. Some products operate on the internet through a web browser and others run directly on your computer without an internet connection. Some products are sold (i.e., licensed) for a one-time hefty fee and others are subscription based (you pay monthly for the privilege of using their software).

The typical hype for these products claim to reduce a 30 year mortgage to about 10 years or less, with no change in: Your lifestyle, your income, or your monthly mortgage payment. That means that whatever your income and expenses are now, you can pay-off your 30 year mortgage in 10 years (give or take a year or two) without reducing your expenses, or increasing your income, or changing your monthly mortgage payment.

Such claims are designed to exploit the financially illiterate.

Here is how the latest batch of nonsense mortgage accelerator programs work:

- Open a revolving unsecured signature credit line with your favorite bank. The credit line needs to be about two or three times your monthly net income after taxes. The interest rate is irrelevant. Let’s say it’s a generous 12.0% annual, compounded monthly (1% per month on outstanding balances).

- Connect the signature credit line as overdraft protection to your checking account. Any overdrafts on your checking account will draw from the credit line.

- Deposit your monthly pay into your checking account.

- List all of your monthly expenses into the program, including your mortgage parameters (term, interest rate, monthly payment, etc.).

- The program then proceeds to generate a list of what payments you should make to what accounts, including a “normal” payment (principal and interest) to your mortgage and a principal-only payment on top of the normal payment.

- The program is designed to tell you to invoke the overdraft protection feature to borrow a generous amount of extra money to pay towards your mortgage.

- Your monthly income is zeroed out each month to pay your expenses. After paying your normal expenses, any excess amount of income goes back into your credit line to pay down the excess debt that your borrowed for your principal-only payment on your mortgage.

The process is repeated each month. You tell the program your expenses for the next month, your income, and the program tells you what to pay for your expenses and your normal mortgage payment, and then the program decides whether to tell you to pull another big chunk of money from your credit line to pay as principal-only on your mortgage. If you are not pulling a big chunk to pay principal-only, then any cash left over from your monthly income after paying your monthly expenses will go towards reducing the debt on your credit line. After a few months, your credit line is zeroed out, and the program tells you to pull another big chunk to pay principal-only on your mortgage.

Note: At no time will the program have any access to your checking account. The program is only advising you on what checks to write from the data that you tell it. You must tell the program what checks you wrote for what expenses, and your net income for each month. The program then tracks your income and expenses, and calculates the balances on your mortgage and credit line (from the data that you input).

What if you are living paycheck to paycheck and don’t have any excess income? Forget about it! These accelerators only reduce your mortgage at an accelerated rate when you pay more principal.

Now, let’s look at what is really happening.

- Let’s start with a mortgage of $200,000 principal balance, 30 years (360 months), 6.0% annual interest compounded monthly, and a monthly payment of $1,199 (rounded to the nearest dollar).

- This mortgage is a level payment, so the principal and interest components of each monthly payment will vary and the total of principal plus interest is always the same amount. As the principal balance reduces each month, the principal component of the next payment increases while the interest component decreases. This is easier to understand when you print a full amortization schedule for all 360 payments that shows the principal and interest components and the running principal balance on the mortgage.

- Suppose your monthly income after taxes is $5,000 and your monthly expenses are $4,000 including $1,199 for your normal (principal and interest) monthly mortgage payment. You have $1,000 excess cash left over after paying all of your bills for the month.

- Your first normal monthly mortgage payment is $1,000 interest and $199 principal. Your mortgage annual interest rate 6.0%, so your monthly interest rate is 0.5% on the balance. Calculate 0.5% of $200,000 is $1,000 interest. Subtract the interest from the $1,199 payment leaves $199 that is applied to principal for the first month.

- Month #1: You tell the program your net income is $5,000 and your expenses are $4,000. The program advises you to pull, say, $6,000 from your checking account (using overdraft protection) to pay principal-only to your mortgage. The program also advises you to pay your $4,000 expenses, including your “normal” monthly mortgage payment of $1,199.

- Your checking account now has a negative balance, showing an amount owed on your credit line of –$5,000 = $5,000–$4,000–$6,000.

- Your mortgage balance is reduced to $193,801 = $200,000–$6,000–$199.

- Month #2: You deposit $5,000 into your checking account and pay your $4,000 expenses. Your account has a negative balance of –$4,050 = $5,000–$4,000–$5,000–$50. You are charged 1.0% (12.0% annual) on the –$5,000 principal balance owing on the credit line.

- Your mortgage interest is $969 = 0.5% of $193,801. Subtracting $969 from your normal $1,199 payment calculates $230 principal payment. Your mortgage balance is $193,571 = $193,801–$230.

The process is repeated until the negative balance on your credit line is zeroed out (or near zero), then another big chunk of money is pulled from your credit line to pay principal-only to your mortgage in addition to your normal monthly payment.

This is technique will pay-off your mortgage faster than just paying the normal monthly payment. However, it is actually costing you more money compared to simply paying the full $1,000 excess cash each month to your mortgage.

You pay $50 in interest charges on your credit line and you still have a –$4,050 balance owing on your credit line. Each month you will pay 1.0% of the balance owing on your credit line until it is zeroed out.

Your credit line is zeroed out from your excess cash flow after several months, after which you again borrow another big chunk of money at 12.0% to pay down your 6.0% mortgage. It is inane or insane, depending on whether you are trying to analyze it or save money with it.

Let’s compare side by side the mortgage accelerator to a direct pay down.

| PRINCIPAL PAY DOWN USING CREDIT LINE | ||||||

| MONTH | BALANCE | PRINCIPAL | INTEREST | CREDIT FEE | CREDIT LINE | PULL |

| 1 | $193,800.90 | $ (6,199.10) | $ 1,000.00 | $ 50.00 | $ (5,000.00) | $ 6,000.00 |

| 2 | $193,570.80 | $ (230.10) | $ 969.00 | $ 40.50 | $ (4,050.00) | $ – |

| 3 | $193,339.55 | $ (231.25) | $ 967.85 | $ 30.91 | $ (3,090.50) | $ – |

| 4 | $193,107.15 | $ (232.40) | $ 966.70 | $ 21.21 | $ (2,121.41) | $ – |

| 5 | $192,873.59 | $ (233.56) | $ 965.54 | $ 11.43 | $ (1,142.62) | $ – |

| 6 | $192,638.86 | $ (234.73) | $ 964.37 | $ 1.54 | $ (154.05) | $ – |

| 7 | $186,402.95 | $ (6,235.91) | $ 963.19 | $ 51.56 | $ (5,155.59) | $ 6,000.00 |

| 8 | $186,135.86 | $ (267.09) | $ 932.01 | $ 42.07 | $ (4,207.15) | $ – |

| 9 | $185,867.44 | $ (268.42) | $ 930.68 | $ 32.49 | $ (3,249.22) | $ – |

| 10 | $185,597.68 | $ (269.76) | $ 929.34 | $ 22.82 | $ (2,281.71) | $ – |

| 11 | $185,326.57 | $ (271.11) | $ 927.99 | $ 13.05 | $ (1,304.53) | $ – |

| 12 | $185,054.10 | $ (272.47) | $ 926.63 | $ 3.18 | $ (317.58) | $ – |

| $(14,945.90) | $ 11,443.30 | $ 320.76 | ||||

After 12 months, your mortgage balance is $185,054.10, you paid $14,945.90 in principal, $11,443.30 in mortgage interest, and $320.76 in credit line interest. The total interest paid is $11,764.06 for the combined mortgage and credit line.

| SIMPLE ADD CASH FLOW TO PRINCIPAL | |||

| MONTH | BALANCE | PRINCIPAL | INTEREST |

| 1 | $198,800.90 | $ (1,199.10) | $ 1,000.00 |

| 2 | $197,595.80 | $ (1,205.10) | $ 994.00 |

| 3 | $196,384.68 | $ (1,211.12) | $ 987.98 |

| 4 | $195,167.50 | $ (1,217.18) | $ 981.92 |

| 5 | $193,944.24 | $ (1,223.26) | $ 975.84 |

| 6 | $192,714.86 | $ (1,229.38) | $ 969.72 |

| 7 | $191,479.33 | $ (1,235.53) | $ 963.57 |

| 8 | $190,237.63 | $ (1,241.70) | $ 957.40 |

| 9 | $188,989.72 | $ (1,247.91) | $ 951.19 |

| 10 | $187,735.57 | $ (1,254.15) | $ 944.95 |

| 11 | $186,475.15 | $ (1,260.42) | $ 938.68 |

| 12 | $185,208.43 | $ (1,266.72) | $ 932.38 |

| $(14,791.57) | $ 11,597.63 | ||

After 12 months, your mortgage balance is $185,208.43, you paid $14,791.57 in principal, $11,597.63 in mortgage interest.

You paid $166.43 in extra interest to gain an extra $154.33 in principal pay down using the credit line. As the process continues, the extra interest you pay always exceeds the extra principal pay down using the credit line. You lose more money each month.

At the end of 36 months:

- The credit line technique has paid down the principal to $152,339.98, you paid $32,597.04 in combined mortgage interest and credit line interest.

- The simple accelerated pay down directly applying your $1,000 extra cash per month has paid down the principal to $152,832.08, you paid $31,999.68 in total interest.

Using the credit line technique, you paid $597.36 in extra interest to get $492.10 in extra principal reduction. You wasted $105.26 in extra interest payments. If you simply applied your excess cash flow to each of your mortgage payments, you would have an extra $597.36 available to apply as an extra principal payment at the end of 36 months. Thus, you can always beat the credit line technique by just paying directly instead of borrowing higher cost money from a credit line.

The results are not surprising that trying to pay down a 6.0% mortgage with 12.0% money is just plain stupid. The credit line technique requires paying higher cost extra money on your mortgage balance, and it won’t work at all when you have no extra money at the end of the month. It also won’t work when the mortgage has a prepayment penalty.

In the above example, both techniques will pay-off the mortgage in almost the same time, but the credit line technique will cost about $2,519.58 in extra interest over the reduced life of the mortgage compared to the simple technique.

Calculating the pay-off using the simple technique is just plugging in the higher monthly payment then solving for the number of periods. In this case, paying $2,199.10 each month, instead of the normal $1,199.10 each month, will pay-off the mortgage in 121.6 months (10 years and 1.6 months). In the above example, the credit line technique will also pay-off your mortgage and credit line in 122 months plus a fraction of a month.

If pulling $6,000 is good, then how about pulling $200,000 to pay-off your mortgage in one month? You then pay $2,199.10 per month for 241 months (20 years, 1 month) to zero out your credit line. Paying off low cost debt with high cost debt is stupid!

This is not rocket science. It’s simple time value of money using a financial calculator or a spreadsheet. You don’t need an expensive useless mortgage accelerator program to save time and money on your mortgage. You won’t save money or time by using the credit line technique. Just deposit your monthly income into your checking account, pay your expenses, then add any excess cash to your monthly mortgage payment. You will save money and time by just keeping it simple.

Besides being just a stupid idea, the programs for using a credit line are very expensive. The last pitch that I quietly sat through had a price tag of $3,500 as a one-time fee for perpetual access to a web-based program. The predators also had the audacity to suggest that you should pay the $3,500 price from your credit line! As if paying extra interest isn’t bad enough, they want their customer to start with a $3,500 deficit on their credit line! If you have the cash available, then you would be served much better by just paying the $3,500 on your next mortgage payment. I leave an exercise for you to calculate both the credit line and simple pay down, starting your credit line with a –$3,500 deficit and starting the simple pay down by paying $4,500 extra principal for the first month.

Very often, I see predators preying on financially illiterate people. The schemes are very savage and cruel, especially for young people. I see young couples attending the seminars of larcenous liars and wasting thousands of dollars that they definitely cannot afford to spend. The predators know that most people are usually maxed out on their credit cards. The first topic taught in the seminar is how to increase their credit card limit. The ulterior motive is to make room on the credit card so they can buy whatever is being sold at the seminar. These young couples are living paycheck to paycheck, probably raising very young children, and they get suckered into wasting their hard earned, precious money or getting trapped into an endless cycle of wasteful personal debt.

After seeing a viral spread of these outrageously priced, worthless mortgage accelerators, I thought it was time that I put my foot down and wrote this blog article as a warning.

Final message: Mortgage accelerators are worse than worthless, because they are designed by predators to prey upon the financially illiterate. There is no magic in paying off debt. The only way to pay less interest is to pay more principal. Shifting debt between accounts is meaningless without reducing the cost of interest.

Check out my Power Debt Plan spreadsheet for a simple inexpensive way to calculate the optimal paydown for your debt.

Jeffrey D. Smith is a real estate investor with an expertise for real estate finance. Jeffrey D. Smith provides real estate investment consultation to wealthy individuals on a private referral basis.

Comments Off on Are Mortgage Accelerators A ScamTags: Business and Finance · real estate

Today’s Quote

May 1st, 2012 · 3 Comments

Stress only has the presence and control in your life you give it.

Richard flint

We can’t always eliminate the causes of our stress. We can change our reaction to them. Stress is not what is happening to us. Stress is our emotional reaction to what is happening.

Happy investing – Ned

→ 3 CommentsTags: Quotes · Success & Wealth Building

Foreclosure 101

April 30th, 2012 · 1 Comment

Guest post By Andrew Hill @ www.NewHomeSource.com

When Buying Foreclosed Homes be Realistic

Buying a foreclosure can be a fantastic adventure in real estate. And if you enjoy finding a great price for a home while getting your hands dirty, then it could be a perfect fit. But when shopping foreclosures you must remember this: if something looks too good to be true, it is. Foreclosures aren’t sold at rock bottom prices without reason. But, if you enter into the transaction with the required knowledge and a good understanding of the property you’re considering, foreclosures can be a goldmine of an opportunity.

Old Musty Bank Owned Properties

The first thing to know is that foreclosures often appear old or musty as a result of being left empty for a significant amount of time. This can make the process of selecting the right home difficult because you have to imagine what you can do with the home in the state it is in. That’s not to say every foreclosure you survey will be dilapidated, but you can’t expect them to look like properly staged homes. Many of the home’s problems will also be invisible to the untrained eye, so you will want to have a professional home inspection completed on a home you are considering.

Be Prepared When Buying Foreclosed Property

By far the most important part of this game is being prepared. The foreclosure market is highly unpredictable and the best deals go quickly. Therefore, the best way to close a deal is to be prepared with an offer at all times. To do this, you will need to get approved for a mortgage and find an agent who specializes in foreclosures. These two things should happen relatively simultaneously. Once you have these prerequisites under your belt, you’ll be that much closer to sealing the deal.

When you find the perfect property, it’s time to make the offer. You will then fill out the appropriate paperwork, which will be reviewed and given an acceptance or rejection within a matter of days. Should your offer be accepted, you can then proceed to the fun, yet labor intensive stage: reparations and modifications. The key here is to set realistic goals as you improve the home. Timetables should be used, but if you don’t meet each deadline, it’s not the end of the world.

When you find the perfect property, it’s time to make the offer. You will then fill out the appropriate paperwork, which will be reviewed and given an acceptance or rejection within a matter of days. Should your offer be accepted, you can then proceed to the fun, yet labor intensive stage: reparations and modifications. The key here is to set realistic goals as you improve the home. Timetables should be used, but if you don’t meet each deadline, it’s not the end of the world.

So long as you consistently put in the effort, the fruits of your labor will not be in vain. In a short matter of time, you’ll have a “like new” property. Whether you want to live in it yourself or try to make a profit from it is another story.

Learn How to Invest in Bank Owned Property

The post above is a guest post by Andrew Hill. Andrew is from NewHomeSource.com a great place to find a new home by the way. And if you want a great place to learn about investing or wholesaling bank owned properties (REOs) you can’t do better than my friend Steph Davis’ Flip REOs for fast cash program

→ 1 CommentTags: Beginner · real estate

332 Woodyear – For sale $24,770

March 19th, 2012 · 4 Comments

332 S. Woodyear St.,

Baltimore, MD 21223

Only $24,770

Call 301-332-5496

- Little or no renovation needed

- Nice Block no board ups

- Easy to rent

- Expected rents $800-$1,000+

- 2 bedroom (3 with walk through)

- Walk to shopping

- Convenient to downtown & Bus Routes

Go to CrabProperties.com for more info and full terms

To see the condition check out the video

* * * Call Now * * *

Ned Carey

Crab Properties LLC

301-332-5496

Go to CrabProperties.com for more info and full terms

→ 4 CommentsTags: real estate

Tax Liens For Sale

March 4th, 2012 · 12 Comments

Earn 18% interest

I have a limited number of tax liens for sale. These are Baltimore City Tax liens which accrue interest at 18%! I am trying to raise money for this years tax sale and would be willing to let some of my current liens go. Some have foreclosures started and I have an attorney ready to start work on the others.

Contact Us Now

Some of these certificates will expire soon if foreclosure isn’t filed. My attorney is ready to go. If you are interested reply to this post or use the contact us link near the to of the page.

Happy investing – Ned

→ 12 CommentsTags: real estate · Tax Liens

Snapple Quote of the Day

January 25th, 2012 · 1 Comment

Today’s quote about self improvement is from a Snapple drink cap. It’s their “Real Fact” #828. I love their fun little sayings.

Snapple drink cap says:

“Every hour more than 1 Billion cells must be replaced”

I love it, however even better I would add

Ned Carey says:

“Every hour you have a billion chances to improve yourself”

→ 1 CommentTags: Quotes

Should Banks Foreclose or Modify?

January 4th, 2012 · 2 Comments

The guys in the video below are fun to watch and high energy. They are of the mind that modifications only prolong the housing troubles. They say more foreclosures short run, will get us back to a stable market faster.

So the question for you is “Should banks increase foreclosures and increase the short term housing market problems? Or should they “Extend and Pretend” at the risk of keeping housing in trouble for years to come? Leave a comment with your ideas.

Are More Foreclosures Coming?

Whatever your point of view, the indication is that buying bank owned properties will will be a key opportunity for some time to come. Learn the best strategies to buy Bank Owned Property Here.

More about Bank owned properties and REO investing here

Happy investing – Ned

→ 2 CommentsTags: real estate

Get FREE investing tips and bargain wholesale properties via e-mail.

Get FREE investing tips and bargain wholesale properties via e-mail.